- EXPORTER: Makes a factoring request first to be financed (receivable finance, invoice discounting) in advance which also allows the Importer to make payment within 3 months.

- EXPORT FACTOR: Per exporters request pre-finance up to 90 percent of the invoice face value.

- IMPORT FACTOR: Bank or Factor Company that guarantees to repay on behalf of the Importer.

- IMPORTER: Repays the invoice face value within 3 months to the Import factor.

Key benefits for the importer

- FLEXIBLE PAYMENT TERM: Easier to do trade business on open account term, and allows the importer to get the short-term buyer’s credit. Mostly up to 3 months.

- WORKING CAPITAL: Improve your company’s working capital and effectively manage the cash flows.

- EASY & AFFORDABLE: Factoring is considered one of the easier and cheaper forms of financing compared with the other documentary payments and trade finance facilities.

- SECURE: Factors Chain International member Import and Export Factors offer factoring services under the General Rules of International Factoring.

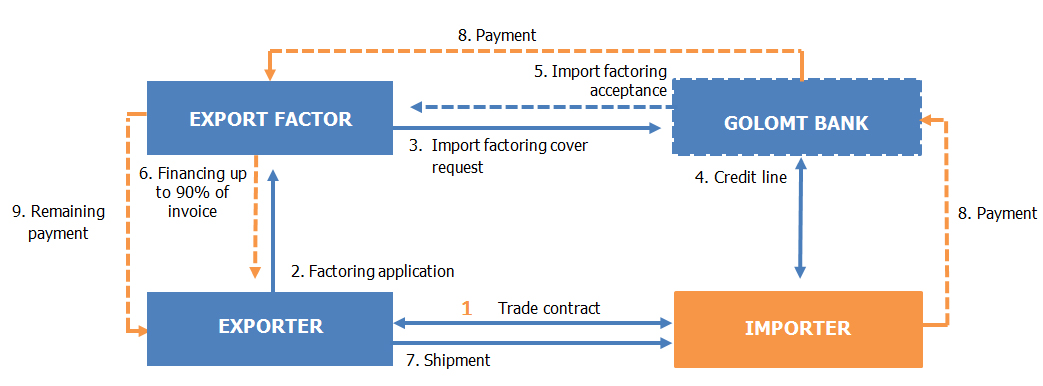

Import factoring scheme

- EXPORTER: Makes a factoring request first to be financed (receivable finance, invoice discounting) in advance which also allows the Importer to make payment within 3 months.

- EXPORT FACTOR: Per exporters request pre-finance up to 90 percent of the invoice face value.

- IMPORT FACTOR: Bank or Factor Company that guarantees to repay on behalf of the Importer.

- IMPORTER: Repays the invoice face value within 3 months to the Import factor.

![e07l0k519fti4lg9f35p1f46m]()

Charges and Fees

- Import factoring service fee – 0.15% (75 USD – 250 USD)

- Import factoring coverage interest (per month) – 0.8% (max)

- Payment – 50 USD

Required documents

- A bank factoring application form

- Trade contract (commercial invoice)

- The loan origination documents will be required

Contact

- Address: Head office of Golomt Bank, Trade and structured finance department

- Phone number: 7575 1111 /1554, 1380/

- Email: tf@golomtbank.com

- What is the difference between a letter of credit or a guarantee?

A LC is usually issued for each purchase and payment is made upon a confirmation of the shipment receipt, while a guarantee can be issued for a longer period of time with regular purchases and payments are made within the guarantee amount.

- What is LC confirmation?

LC confirmation is required by the exporter that a local bank’s LC to be confirmed by a high-ranking International bank which means the International bank is obliged to honor the LC payment as well.

- Can LC or bank guarantee be amended?

The terms of the LC and guarantee can not be amended or cancelled by one party’s request. In case of both parties agreed LC and guarantee terms can be amended as many times. For example: increase the amount of the LC, postpone the last date of shipment, change the name of the port of shipment etc.

- Does it require to include that all the LC related terms should be stated in sales agreement?

Not required.

Trade agreements and LC and guarantees are separate agreements. Although the bank opens LC and guarantees based on underlying sales agreements, the parties will need to agree on the terms of the LC and guarantee, regardless of the terms of the agreement.

- When will the import letter of credit be paid?

There are varies of ways in terms of payment of a letter of credit. For example:

1) At sight payment: that is payable immediately (within 2 to ten days according to the bank internal rule) after the seller meets the requirements of the letter of credit,

2) Deferred payment: after the agreed period of time after the shipment date (30, 60, 90 days, etc.),

3) Mixed payment: a combination of sight and delayed payment terms,

4) Post-financing: prepayment by a bank financing and conversion into a loan in order to defer payment of the letter of credit.

- What is the difference between a letter of credit or a guarantee?

- How to issue a letter of credit?

The letter of credit will be issued as following two types in terms of funds:

1) Funded letter of credit: the buyer places funds for the required payment are held in a separate account. In this case, the risk fee and annual fee are not be charged.

2) Unfunded letter of credit: The bank opens a LC by backing credit assessment, as it will bear the payment risk on behalf of its customers.

- What is a letter of credit?

A letter of credit is a letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount.

In other words, a letter of credit is a guarantee of a bank’s payment of the full amount in a timely manner upon submission of documents proving that the goods were delivered in accordance with the agreed terms.

- How to issue a letter of credit?

This website uses google analytics

This website uses information gathering tool which is Google analytic in order to determine the effectiveness of our online campaign in terms of sales and user activity on our sites.